There are estate-planning disasters, and then there are the “quit the business that you grew into a phenomenon, become addicted to various substances, buy random parts of a town in Utah and die in a literal fire of your own making” kinds of disasters.

That was the swan dive that Tony Hsieh executed on the way to his demise. After 20 years of leading Zappos to world-class success and redeveloping parts of downtown Las Vegas, Hsieh unraveled in spectacular fashion.

Hsieh died soon after firefighters pulled him from a building in Connecticut charred by a fire he set, leaving not only an estate worth hundreds of millions of dollars but also a mystery as to what he wanted done with it. Although he had substantial assets, the 46-year-old did not leave a will or any estate-planning documents.

Hsieh’s father and brother are trying to pull together all the property he bought and promises he made, sometimes on sticky notes, during the months leading to his death.

In some ways, Hsieh was another indirect casualty of the COVID-19 pandemic. He grew increasingly erratic after the lockdown began, resigning from Zappos in August 2020 and dying three months later.

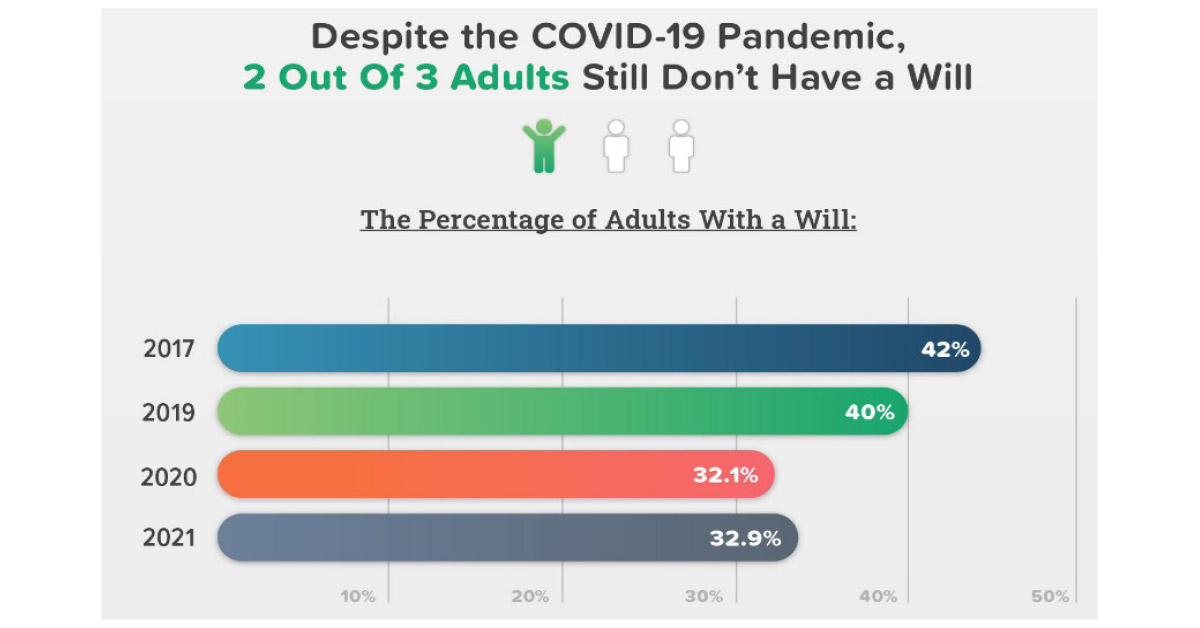

Although the pandemic increased awareness of mortality, only about a third of Americans thought they should consider planning their estates or should even consider preparing a will, according to Caring.com’s annual wills survey. And only about a third of those people did anything about it.

Those who did pursue planning tended to be younger than indicated in previous surveys and tended to be in higher income brackets.

Will Willingness

Advisors confirmed that they had more people speaking to them about estate planning and insurance during the pandemic. Even so, some advisors are still surprised by how many people do not believe they need a will.

Gabrielle Clemens was not surprised. Although she serves an affluent clientele in her wealth management practice in Boston, she does not assume that new clients have attended to their planning.

Just as Caring.com’s survey found that about 30% of Americans do not think they have enough money to require a will, Clemens said that statistic even applies to many people who have been referred to her.

“They don’t think they need it because they don’t think they have enough money, and it’s just not true,” Clemens said. “So yes, I have clients who don't have wills, don’t have trusts, don’t have any kind of estate planning in place, and it’s a recipe for disaster right there. I mean if you have a million dollars, you need a will.”

Clemens takes a blunt approach on the subject. She does not dress it up to persuade the client. She just simply tells them they need a will and other planning. Then she tells them why.

Often, people have not considered all the elements of their lives that need buttoning up — and what happens if they don’t get things in order.

Sure, they might have a beneficiary named on their 401(k) at work, but is that beneficiary still correct? What about their other accounts? What about their house?

“Who’s going to get your home if you’re not married or you don’t have children and your parents are gone?” Clemens said. “What happens if you don’t have an estate plan? If you don’t have your home in a trust with a named beneficiary, then it’s going to go through the probate process in court. And it gets cumbersome and expensive, and it’s difficult for the people who are trying to administer your estate.”

Difficult would be an understatement for what Hsieh’s family is still going through. His father and brother had to visit Park City, Utah, to get a handle on his affairs there. Hsieh had big plans to bring art and commerce to the upscale town, whether its residents wanted it or not. He bought many properties there and entered into an unknown number of agreements, some of which are written on sticky notes that his family must gather for probate court.

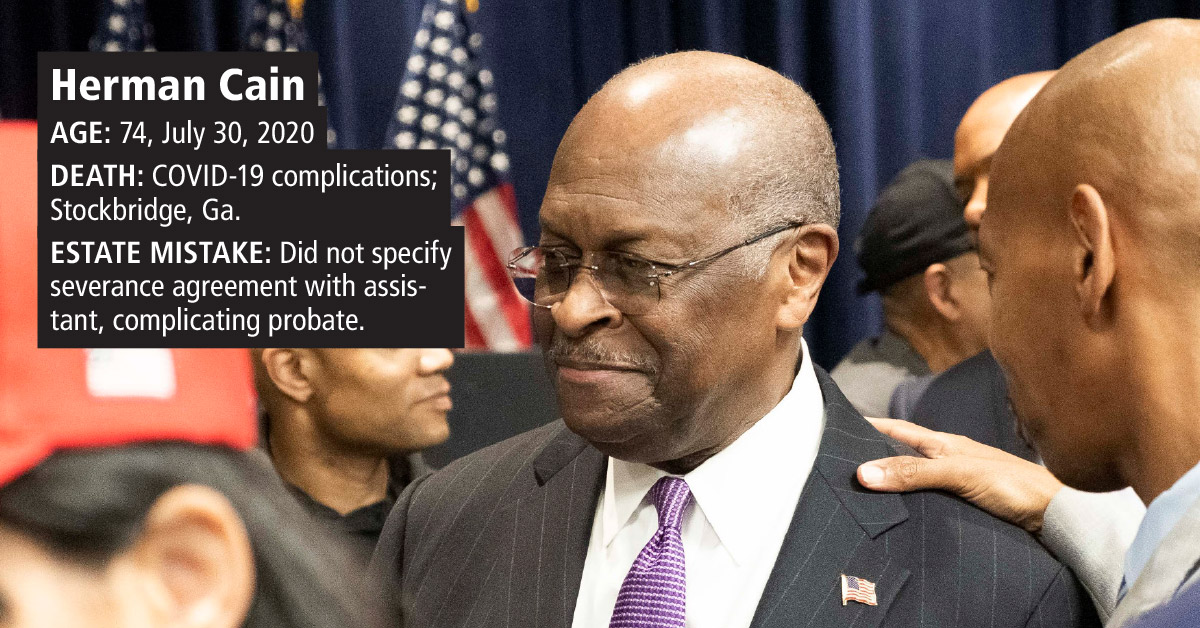

Another recent case of failing to detail agreements adequately was Herman Cain, who died after contracting COVID-19. His assistant, Lisa Reichert, claims that Cain promised her a severance deal that she plans to pursue despite not producing a document with the details.

An observer can write that off as Reichert’s bad luck in apparently not getting it in writing. But she is making it difficult for Cain’s widow and estate. Reichert claims that Cain’s widow is undercounting the estate by leaving out gold bars and coins she claims Cain kept in a safe deposit box.

In Hsieh’s case, he did write down his agreements, but haphazardly, and often on sticky notes.

Clemens said he has not had a client go off the rails in the way Hsieh did, although she did have to untangle a situation in which a client’s spouse devasted the family’s finances because of a gambling problem.

What she sees most often is the effect of dementia — and of simple loneliness. She has had a few clients, typically widows, who have been unduly influenced by someone taking advantage of them.

There was the example of a client, a “well-known woman,” who was asking for a sizable amount to be sent to a person. First it was $15,000, so off the money went. Then another $15,000, sent again — after all, it’s her money. Then came the request for $75,000. Clemens got on the phone to ask the client who this person was.

“She said, ‘She’s right here. Do you want to speak to her?’” Clemens said, adding that she most definitely wanted to speak with her. “She got on the phone, and this woman says, ‘Yes, I’m her spiritual advisor. I’m a psychic. And I see very negative things coming toward your client, and this money will clear it.’”

Clemens said she was able to help her client gain some “clarity to her thought process” and help her understand what “negative things” might actually exist in the situation.

It was an example of the growing problem of charlatans preying on vulnerable seniors, especially in their most difficult times, which were made worse by the loneliness deepened by the pandemic.

Family Time

Hsieh’s family is losing time having to organize the pieces of the estate, but they are also losing substantial money. The estate is worth hundreds of millions of dollars. Forbes estimated that the estate is worth $840 million, but who knows? The probate court is still getting a handle on it several months after Hsieh died.

The Park City house and property he occupied is worth $16 million alone, exceeding the $11.6 million estate tax exemption all on its own. People in Las Vegas are beginning to realize that about 100 of Hsieh’s properties there could be going to auction.

Without the proper planning, 40% of the proceeds from that sale and the rest of the estate will go to the federal government. That is not counting the legal fees, other probate costs and state taxes.

Given Hsieh’s civic-mindedness, he probably would have preferred the money had gone another route, said Harry S. Margolis, a Wellesley, Mass., attorney Clemens often works with.

Without a will, the state says the money goes to the closest relatives.

“Which may be what he would have wanted anyway,” Margolis said. “But he was an interesting guy. I mean, he created a whole new neighborhood in Las Vegas and had an idea of how people should live there. He may have wanted to have money go to a nonprofit to support some of those ideas and to create a legacy.”

His family might still do something like that, but they will have to do it with 40% less money. Hsieh could have leveraged even more than his money’s worth if he had set up charities.

“The tax code is very supportive of rich people setting money aside for charity,” Margolis said, adding that it does not mean they lose control of the money. “They control what the charity does, instead of the taxpayers, but they’re allowed to do that.”

Chadwick Boseman is another example of a celebrity who died without a will. In the case of the “Black Panther” actor, he did not do any estate planning even though he had been suffering from progressive colon cancer for four years before he died at 43.

Boseman’s widow had to go to court to get control of his $938,000 estate. Although he died in August 2020, the court did not grant control of the estate until November.

Tangled Webs That Families Weave

Hsieh and Boseman are the latest high-profile instances of well-known people dying without a will. But usually the problem with celebrity estate-planning is a complicated personal life.

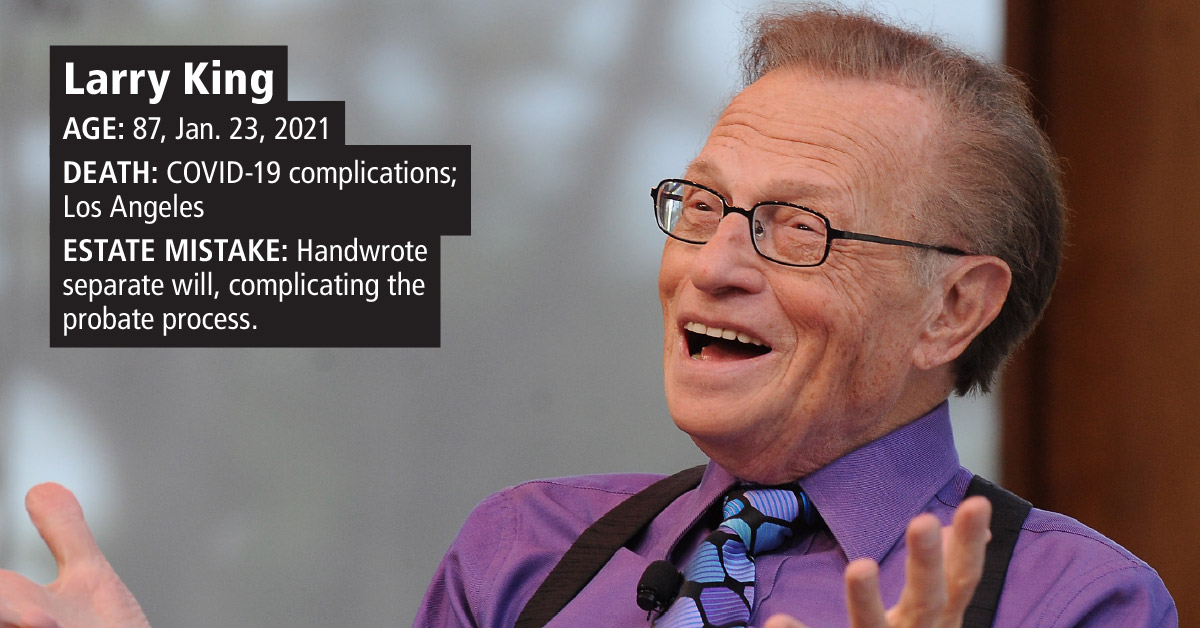

Larry King was a classic case of that. When he died at 87 in January, he had been married seven times and was in the middle of a divorce.

His widow was lucky that the divorce was still pending, but his children, not so much.

Although King had done estate-planning, he apparently handwrote a secret will that would have split his estate among his five children and did not mention his wife.

Thomas J. Archer of The Archer Financial Group counts many celebrities, athletes and uberwealthy among his clients. From his practice on Manhattan’s Park Avenue and in Boca Raton, Fla., he sold $2 billion of life insurance in 2020. He says he has strategies to “divorce-proof” estates for the complicated lives he encounters with his clients.

Planning starts with the basic documents and grows from there.

“The will is just the basic document, and then you need the trusts and the powers of attorney and all of those things that come along with it,” Archer said. “Once you have all those documents in place, then you have to take a look at your assets, and you have to say all these assets are liquid or are illiquid. If they’re illiquid, you have to ask how is my family going to come up with the dollars to pay the tax on this stuff regardless of who’s getting it, regardless of if it’s a second wife, a third wife, a stepchild.”

Of course, that is a wide-open opportunity for life insurance, but it also means nailing down all the details first. Maybe life insurance works in a particular case, or maybe it doesn’t. Archer said the planning exposes the need and starts the process of filling that need.

That process rarely yields a simple answer. A half-prepared estate can lead to a complete disaster. Archer can reel off many high-profile examples of families that have lost professional sports teams and other large assets.

“They just did basic planning, and they didn’t buy any life insurance for liquidity,” Archer said. “They were forced to sell their assets in order to pay the taxes.”

Archer says he is an insurance man but emphasized that the full scope of planning must come first for the client’s sake.

“You can write a will on a roll of toilet paper. It still counts,” Archer said. “But you really have to get those thoughts down on paper with signatures and witnesses. Otherwise, it ends up in the courts, and then they decide where things go. You’d be surprised how a lot of this stuff doesn’t go the way it’s supposed to go.”

The next step is to keep up with clients. Archer said he reviews his clients’ documents annually to ensure they are up to speed, even if he has not done business with them in years. He said if an agent does not do that, the clients’ plans can age poorly.

“Back in the ’80s, the exemption was $600,000, so people would say, ‘I’ll leave the exemption to the kids,’ and at that time, they meant $600,000,” Archer said. “If that client is worth only $2 million and the wording is still there that I leave the exemption, the exemption now is all the way up to $11 million, and now the wife says, ‘Oh, my God. I don’t get anything.’”

In John Singleton’s case, the director of “Boyz n the Hood” had not updated his will since 1993, soon after his first daughter was born. When Singleton died at 51 of a stroke in April 2019, he had seven children, but they all may lose out on any money because only one of them was named in Singleton’s will.

His mother has asked the probate court to review the estate. All of this will drain part of the $3.8 million estate and leave a legacy of disappointment no matter how the probate court works it out.

Partners For Better Planning

Estate-planning advisors and attorneys have something in common — they need each other for a sound practice. Besides providing technical assistance, one professional can help support the goals of the other.

For example, Lawrence D. Mandelker is an attorney specializing in estate planning and multigenerational asset transfer and preservation for high net worth individuals from his Venable LLP office in Rockefeller Center.

When Mandelker is working with clients, he is not just setting up documentation — he also is helping life insurance agents ensure that their clients’ life insurance accords with their wishes. Mandelker spots holes in planning and helps the agent learn to ask smart estate-planning questions.

“Sometimes people don’t realize that they need estate planning done, so they’ll contact a life insurance agent and say, ‘I need a life insurance policy,’” Mandelker said. “And the insurance agent will say, ‘Have you decided how you’re holding this policy?’”

The answer has implications not just for taxes, the most obvious impact, but also for the very health of clients’ beneficiaries. Is it enough to have a $10 million policy and name a child as the beneficiary? Legally, yes. Some people even think that is all estate planning requires.

But do people want a 10-year-old to get $10 million? Probably not. Of course, for a minor, there are going to be some restrictions. How about a 19-year-old? As an adult, they can get the full amount.

“Do I want my 19-year-old sophomore in college to receive a $10 million check tomorrow?” Mandelker asked. “What’s that going to do to his ability to concentrate in school? What’s that going to do to his feeling that he needs to work hard? Is that going to change his lifestyle? Is he going to think, ‘Oh, I don’t need to work. I’ve got $10 million.’”

He helps in other ways as well. For example, he knows how to guide clients to see estate planning and buying life insurance as an expression of their vision and love rather than as a chore.

He starts from a point of agreement on the chore perspective and builds from there.

“There are things we do not because we want to but because we should. Insurance falls into that category,” Mandelker said. “I don’t want to pay my casualty insurance, and I certainly don’t want to be in a position to collect the benefits, because that means that my house has burned down, but I want to do the responsible thing to protect my family. The same idea applies to life insurance, where I’m betting that I am going to die this year. I want to lose that bet, but I want to do the responsible thing and make sure that my family is protected in the event I ‘win’ the bet.”

He mentions what many people find uncomfortable about insurance — that you are betting money that pays off only if you die. And losing the bet that year means have persisted in remaining alive. It’s an odd lose-win situation.

Then he goes a step further.

“There are many reasons why someone may want to invest in a life insurance policy. They may view it as a diversified investment or as a way to replace lifetime earnings and ensure that certain expenses, such as the mortgage, college or estate taxes, are paid for in the event of an untimely death,” Mandelker said. “Once you’ve made the decision that it’s a good use of your assets, then the next logical step is to make sure you get the most benefit out of it. You want to work with your advisors to reduce taxes and other expenses that affect the death benefit ultimately received and to make sure the proceeds of the insurance are paid in the way most helpful or appropriate for your beneficiaries.”

Many insurance agents and financial advisors saw quite a bit of activity with clients who came to appreciate a sense of mortality during the COVID-19 pandemic.

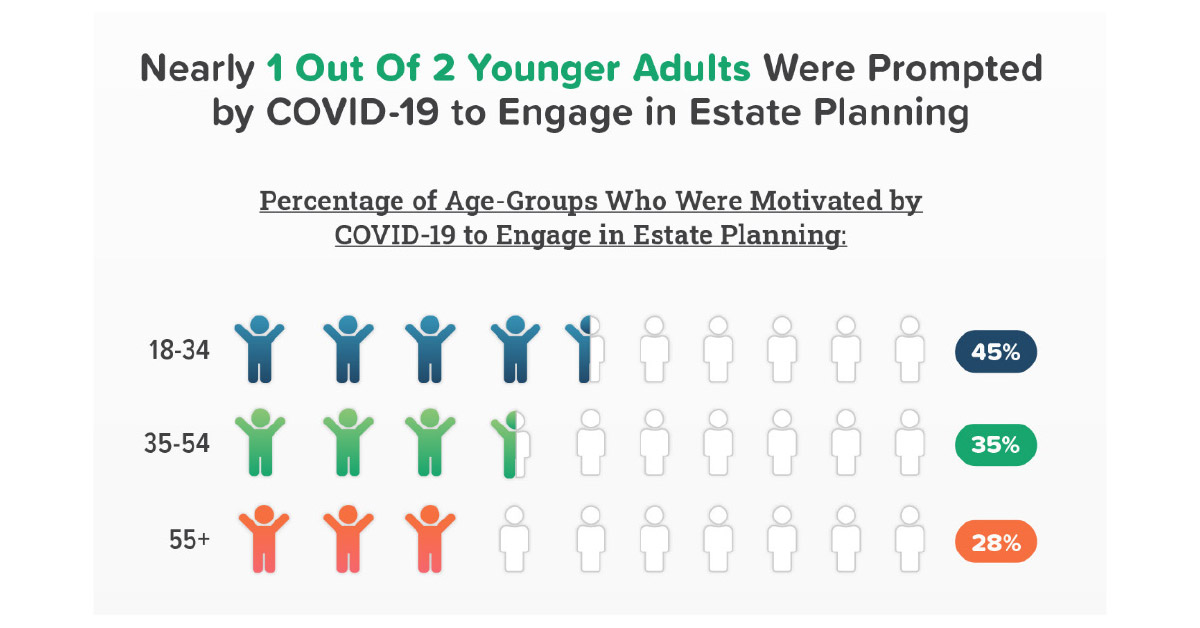

But a survey found a surprising result — it was mostly younger people who recognized their risk and took action, according to Caring.com’s 2021 Wills and Estate Planning Study.

For example:

- The number of young adults who have a will has increased by 63% since 2020.

- In 2021, 18-to-34-year-olds are, for the first time, more likely to have a will than are 35-to-54-year-olds.

- Despite COVID-19, the overall percentage of Americans who have a will has not significantly changed.

In fact, middle-age and older adults are less likely to have a will now than they were the year before. Now, 18-to-34-year-olds are 16% more likely to have a will than those in the 35-54 age group, Caring.com said in releasing the study. The younger generation was also the most likely to cite COVID-19 as the reason they started taking estate planning seriously.

The pandemic might have just made younger people realize that estate planning is not only for old people, said Patrick Hicks, head of legal at Trust & Will.

“The unknown aspects of COVID-19 were an unexpected shock that helped many younger Americans realize that estate planning is important precisely because you never can know what the future may bring,” Hicks said. “Having a plan in place is one small step to protect you and your family from otherwise uncontrollable risks.”

Caring.com partnered with YouGov.com to survey 2,500 Americans to see who is engaging in estate planning and why or why not. The survey found that although the COVID-19 pandemic has increased people’s desire to get a will (35% saw a greater need), the overall percentage of people with a will hasn’t changed since the previous year — two out of three still don’t have crucial estate planning documents.

"celebrities" - Google News

May 01, 2021 at 12:33PM

https://ift.tt/3udiakW

When Celebrities (Still!) Go Wild - Insurance News Net

"celebrities" - Google News

https://ift.tt/3bWxE3n

https://ift.tt/3c1BIiT

No comments:

Post a Comment